How e-Invoice actually works?

The e-invoice workflow

So how does the whole process of sending and receiving of e-Invoice is like and how long does it take for the validation process?

While it involves a series of complex procedures to ensure a safe digital transaction between supplier and buyer, most of the processes will be conducted within the system, and does not require user’s intervention, and for the validation process, according to LHDN, it will be conducted electronically, which can be done instantly or near-instantly.

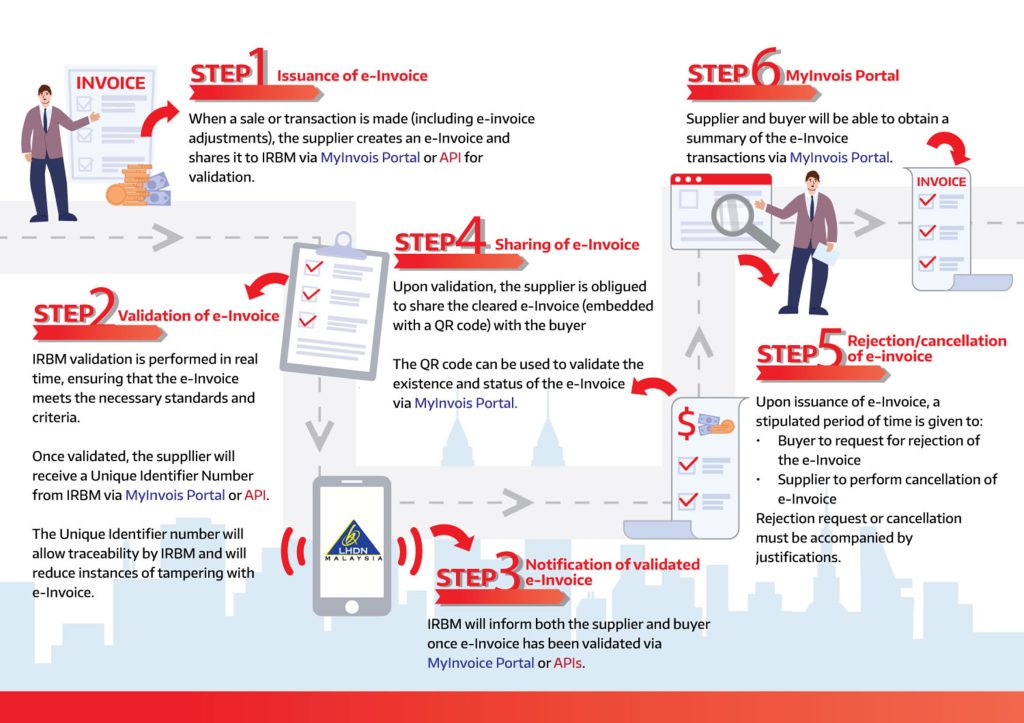

Step 1: Issuance of e-Invoice.

The whole e-invoice process begins when a sale and or transaction is made (including e-invoice adjustments), which the supplier or sender create and e-Invoice to share to IRBM via Myinvoice Portal or API for validation. For accounting solution such as AutoCount, this feature is connected through API, by including e-Invoice within our system, users can have a more complete and automated invoicing process, without the need of accessing portal often to send and receive invoices.

Step 2: Validation of e-Invoice.

As the submitted data needs to be validate before release, to ensure the e-Invoice meets the necessary standards and criteria, and according to info provided by LHDN, the validation process by IRBM is in real time or near-instantly.

After the validation process, the supplier will receive a Unique Identifier Number from IRBM within the platform they operates on, and the number will allow IRBM to trace as to reduce instances of tampering with e-Invoice, further strengthen the transaction’s safety and transparency.

Step 3: Notification of validated e-Invoice.

After e-Invoice validation, IRBM will notify both supplier and buyer, either in MyInvoice Portal or APIs.

Step 4: Sharing of e-Invoice.

Upon validation, the supplier is obliqued to share the cleared e-Invoice with the buyer, with a QR code embedded within, which the purpose is to validate the existence of the e-invoice by enablling checking or view in official MyInvois portal.

Step 5: Rejection/Cancellation of e-Invoice.

After the e-Invoice has been issued, a stipulated period of time is given, to allow buyer to request for rejection of the invoice or supplier to cancel the e-Invoice in the process. In this stage, any rejection or cancellation request must be accompanied by justifications.

Step 6: MyInvois Portal.

While there might seems like there are a series of complex procedures involved to send and share invoices, but worry not, with solution such as AutoCount, the e-Invoice feature will be embedded within the system, which users only have to select or enter some basic detail to generate invoices, and let the system automates the rest while keeping you updated, integrating official e-Invoicing within the system also maintain a better data integrity, accuraccy and safety.